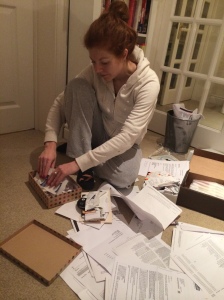

Well, as predicted there have been tears. This weekend was spent gathering six months worth of bank statements, credit card bills, phone bills, receipts etc, as recommended in Money – A Love Story. It was an unholy mess. My tummy felt sick, my chest felt tight, then I felt proper panic and then I started crying.

I hate myself when it comes to money, really, really hate myself.

It’s like looking through a giant magnifying glass at all that is bad about me. I’m reckless, stupid, vain, careless, deluded… I know that in life in general I am not a bad person but with money I feel like I am. It makes me feel sick and ashamed. I am crying now, again, as I type this.

As a freelancer I have to do my own tax return and so I deal with this feeling once a year – but usually I’m earning enough at the time to deal with whatever mess I’ve created. I vow to change my ways but I never do.

This year is different because I seem to have stepped away from paid employment in order to have a re-think. I don’t have any regrets about that, but the money thing is now reaching crunch-point. I’m now more in debt than I’ve ever been in my life.

In December, for the first time, I had to borrow money to pay my tax bill. It was stressful. I phoned up the tax people who, quite rightly, told me that I’d been spending money that wasn’t technically mine and they could take legal action. That conversation, actually the one I’d been imagining in my head for years, confirmed everything I thought about money: I’m a stupid, bad, spoilt brat and people hate me for it.

They told me I had to find the money, so I took out a loan. I am now having conversations HSBC about paying back the money I owe them. I’m going to meet them at 3pm. All of this is my doing, so I’m not in anyway asking for sympathy, I’m just trying to be honest, something Kate Northrup says is very important.

One of the things she asks you to do is to look through six months statements and see if there are any patterns as to where you money is going. Here’s what my bank statements showed me:

I AM THE QUEEN OF COFFEES

Costa, Starbucks, Cafe Nero, Strada, Pret a Manger, some pub or other, another pub or other, Thai restaurant, Italian restaurant etc. Some days, when I’m in London, I can whip through £30 on coffees, croissants and sandwiches in the day then another £35 if I meet friends for dinner and more if we go on drinking. That can be up to £100 on nothing but eating and drinking. My mum works hard as a teacher but rarely has coffee out because she cannot justify £2.50 for something she can make for pennies at home. Here I am, Lady Muck, doing only minimal paid work and ordering coffee number two, three, four – with cakes.

IT COSTS A LOT TO LOOK THIS AVERAGE

Blow dries at £25 a pop, nails another £25, £42 at Boots for God knows what, £22 in Holland and Barrett for stupid vitamins, £70 hair colour, £70 facials. Because I sometimes get photographed for work, I tell myself that it’s important to look as nice as I can but why can’t I do my own nails? Wrestle with my own wild hair? Laziness and vanity. I’m a classic example of the: ‘I’m worth it but I can’t afford it’ generation. I do the same with clothes. And it’s not as if I ever enjoy this spending, I feel guilty about it straight away.

IT’S EXPENSIVE TO TALK

Then my mobile phone bills. It would seem that my AVERAGE phone bill is £143 a month. £143. I had no idea. In December alone, I spent £84 calling my best friend in Ireland. I knew it would cost a bit more to call Ireland but had never actually took the trouble to find out how much more. And, of course, I never opened the bills. Heaven forbid.

MYSTERY DIRECT DEBITS

Then the subscriptions – £14 a month for a magazine subscription that I don’t even get anymore. Nearly £20 for the online Times package, even though I go out and buy the actual paper most days. There are a couple of direct debits that I cannot identify and have probably been coming out of my account for years. Again, stupid, careless.

THEN – THE MYSTERY MONEY

£100 taken out here, another £100 there – I have no idea what it got spent on. It may as well have vanished into thin air.

WHAT A EFFING IDIOT I AM. A TOTAL EFFING IDIOT.

The whole time I was doing this I had mum in my head. She would be disgusted if she knew the way I burn through money. I am disgusted.

Kate says that you have to forgive everything you’ve done and realise that it was the ‘perfect’ decision at the time. I’m finding that hard. Nothing about it seems perfect. Right now I just wish I was someone else.

FOCUS ON WHAT YOU’VE GOT

Instead of disappearing into a black hole of self-loathing, on a practical level, Kate says there are two things you have to do everyday: look at your bank balance and give thanks for everything you’ve got.

Kate says that ‘what we put our attention on grows’. So if we put all our attention on how broke and stupid we are with money, that’s what we’re going to get more of. However, if we put our attention on what we do have, we’ll attract more ‘abundance’ into our life. Abundance is a very popular word in the self-help world.

So this morning I looked at my two overdrawn accounts and gave thanks for the tiny amounts left in each before I hit the limits. Kate says that if you don’t have money coming in, you can be grateful for the other things in your life – your friends, your family, the nice cup of tea you’ve just had.

I gave thanks for a lovely bright day, my wonderful, gorgeous, funny friends (who are worth spending £80 to talk to), my healthy body and the heat coming out of the radiator. It felt good.

MONEY MANTRAS

I like the money magnet one, and also one that I read somewhere else: ‘Money comes to me easily and effortlessly.’ I am now repeating that over and over in my head.

It’s not really working yet. I still fell sick to my stomach, and I still want to cry but Kate says that’s OK. ‘You’ve got to feel it to heal it,’ apparently. So there you go. Right now I’m feeling rubbish but I hope it will pass.

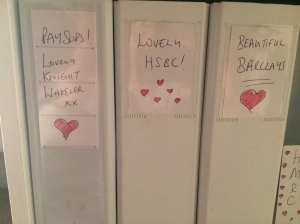

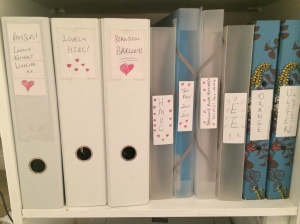

The final thing she recommends, is to get organised – physically organised – when it comes to your finances. She says to put statements in lovely files to try to make them as appealing as possible. Or if you get bills online, save them (rather then ignore them) and give them nice names. She refers to bills as ‘Invoices for blessings already received’, it’s a step too far for me but… this is what I did at 10pm last night:

Yup, I filed my statements and tax letters and put on labels called ‘Beautiful Barclays’ ‘Lovely HSBC’ and then I drew hearts around my HMRC folder. Totally nuts but what the hell? It can’t hurt.

—

Your doing well!!. I know the feeling….you put a tenner in your purse..the next time you open it ..it’s gone!! ;(

http://vodkaandarose.blogspot.co.uk

Thanks Jessica, maybe we’re magicians?!

We live on a budget, but not like most people, we actually live it. There’s exact amounts of money designated for things, like $300 dollars for gas. Those go on a prepaid credit card, yes, we take it out of the bank and put it there. No overdraw chances, if you are running out money then don’t drive places you don’t have to. $50 dollars for the water bill, if it’s $37.49, we pay $50. It’s in the budget so that’s where it goes. There a budget for things that are not in the budget. The little bills like netflix, hulu or things like that, we pay them once a year and our monthly budget has more room for dates, babysitter and unplanned things. Everything left over comes out of the bank to a little envelope that says “savings” (holidays, birthdays, trips, etcetera ) and of course, an excel spread sheet. Somehow, we manage to go on dates every weekend, private school for my daughter, YMCA , and many things that I always thought were impossible with the income we have. Why all this? Because my husband and I used to be like you. It took over a month to get in order and learn to keep track of everything but we are doing it. So far we are remodeling the house, all thanks to that budget.

Natalia, you’ve just brought a tear to my eye (again, it’s a weepy day) – but in a good way. I thought when I started reading your message that you were going to tell me – quite rightly to get my act together and grow up – then it was a surprise to read that you and your husband used to be like me. Thank you for sharing. Do you feel a satisfaction in tracking it and budgeting? I imagine you do – you are in control of your life and there must be great security in that. Great news about your house too. Thanks so much for reading and for writing.

Aw don’t beat yourself up. I know exactly how you feel, but you are not an idiot and you are not alone, there are thousands of women who live like this. Congratulate yourself as the first step is facing up to it and really being aware of what you spend. I am 58 and have lost count of the times I have done what you are doing, but I have never really changed so I would be interested if this book brings about lasting change. The past is past, don’t feel bad, you have enjoyed your money and are young enough to turn it around, so well done and keep going but beating yourself up over it is not constructive

Annwae,thank you. I’m going to call time in the beating myself up stuff by the end of the day. I’m allowing myself to wallow in the self-loathing a bit today. Yes, only time will tell if things change in a lasting way. Why do you think you are the way you are with money? Is is a female trait? I have lots of girlfriends who are fantastic with money. Is is a personality thing? One’s upbringing?

Aahh please don’t feel bad; there are loads of us in the same boat. It makes you feel ashamed and embarrassed but you are now doing the right thing. Hopefully we are all on the right track and due some good luck! Xx

Jill, thank you so much. I hope we’re all on the right track too. Your message means a lot. Onward and upwards – though may need to buy more mascara after the last few days… it’s all down my cheeks now!

Totally relate to & empathise with this post!

Molly, I always thought you were good with money. I remember you being saintly with bringing in your own lunches to the office. Thanks for the support. A scary one to admit to in public, feel very exposed. It helps that I’m not the only one. Money is just one of those things we don’t talk about. xx

Hooray! I found my long lost money twin, just sub your family for a stressed out single mom on welfare. Somehow we ended up with the exact same relationship, go figure. I over drafted my account last and can’t make my portion of the rent for my apartment with boyfriend which make me feel like a moron. Low and behold, I stumbled upon you, a lovely and courageous red headed twin.

Monique, thank you! Sounds like we had the opposite upbringings and ended up in the same place. Have you read Kate’s book? Are you making steps to change? Thanks so much reading and for writing. Love your courageous red headed twin! xx

Hi, as one Brit to another who has been in this mess, can I recommend you look at You Need A Budget when you’re at the budget stage – it’s transformed my financial life! 🙂

Jo, thank you -just googled, it looks great.

Is non self-help-author advice welcome? I was a freelancer for 8 years, and the budgeting was exhausting but I learned a few tricks to make it not as bad. Personally (though I think you know I’m not an affirmations gal) it seems to me that practical action is more affirming and satisfying than platitudes. (But then, I’m not exactly rolling in it, so who am I to say!?) Anyway, some tips and tricks: 1) Making coffee for yourself can be lovely! I know it defeats the whole social purpose of it, but you get to choose the exact type of coffee you like and dress it up however you want. I add cinnamon or nutmeg to the grounds and stir it in before the water hits. 2) Skype! Can you free-skype your lovely friends in Ireland? They will forgive if your hair and nails aren’t professionally done, promise. 3) Unclaimed funds! Have you ever searched unclaimed funds? Search “unclaimed property” via the government office of every place you’ve ever lived. Tax Man might owe *you* money, or there may be floating un-cashed checks somewhere. 4) Clear nail polish or lighter colors: Much easier to do yourself than darker color, and you can make a little “me-time” ritual of it with a glass of wine and some quality TV. And pedis are usually more expensive and toes are easier to do yourself. 5) Rent! You’ve already taken steps, Marianne! You’re already helping yourself. You got rid of your biggest expense and have allowed yourself the living space to turn things around. Give yourself credit for that!

Ugh, I’m taking the opposite approach as you – getting worse with splurging these days even as I’m trying to save up. I will look to you for inspiration xoxo

Love this, Zoe. Thank you. Will reply to your email later, a busy day here. xxxxx and xxxx

Hi that’s what I thought too, get Skype and the Walmarts here in the USA have Straight Talk which is a no-contract cell phone through Verizon. 50 bucks a month , unlimited talk, text and data.

Pingback: 3 Dire Reasons to Simplify Your Life - Be More with Less

Tell the world, like Marianne. Love it. I seem to be sharing stuff with the world that I wouldn’t ordinarily tell my best friends or family. Oh well! Thanks for this. xx

Marianne, I seem to be on the same wavelength as your mum, being of her generation. I wonder whether you thought of re-routing your calls to a budget network, e.g.: http://www.18185.co.uk. I do it routinely when calling Poland. I have this code: 0808 1703703 stored on my phone and dial it out before dialling an international number. I checked the rates for Ireland and it is 1p/min.You’d have to spend an awfully long time on the phone to run up a bill to the amount you mentioned.

Halina, Thank you. Does the budget network work for calls to a mobile? Let me check. Thank you. x

Heart around the inland revenue. Love it.

Enjoying your Feb journey and will be buying the book when there is a tad more balance than £2.26 available. But having taken inspiration from your blog. I am proud to state I have not borrowed money during the last week of the month to cover DD’s which I would normally do. Hurrah for baby steps.

FABULOUS ELAINE, as you say – baby steps.

Lots of great tips from other contributors here – so I’ll just say, Don’t beat yourself up! Honestly, there’s loads of people in the same boat. The good news is you’re at the height of your earning career and you’ve got the spendy phase of your life behind you now.

Regarding the coffees, lunches, etc, why not implement a rule that you’ll make your own coffee – unless you’re meeting somebody (work colleague, contact, friend) and can justify the fiver going from your budget? The trick is to ignore the gorgeous pastries just beside the till…

Mary – thank you! I think you’re right re the spending phase of life being over, or at least reduced. And yes, making my own coffee is definitely a much needed step. I always use coffee shops as a way of getting out the house. Working at home can drive you crazy. But maybe I need to do it as a twice a week treat – and only one coffee. Not four, plus cakes… How are you? Thanks so much for reading. Are you good with money? x

I’ve been a freelancer for ten years, and I still don’t have it figured out. Because the pay is sporadic and ranges from $100 to $3000 a pay cheque, I just can’t seem to make it so that we have enough month at the end of the money. We don’t actually have any debt, and when we do it’s never more than $1500 (and this is all now because we had to go bankrupt before), but because of my pay we get really behind on paying bills and then when the money arrives, we owe back pay plus what’s currently due. I don’t do coffees or lunches or buy a shitload of stuff. But I feel the same self-loathing. What business woman can’t get it together in over ten years? I am never without work, so I’ve got that down. But the truth is, I think, that my inefficiency during the day (look! I’m not working right now!) is to blame. and my lack of belief that even if I were to work 8 hours a day copy editing and proofreading, I’d still not have the money flowing in regularly.

So I think you hit on something there: changing my negative thinking and focus, and in that positivity, regarding both myself and money, hopefully what will result is a motivation to work efficiently and see a difference in pay, and also get organized and more professional so I feel good about me.

My thoughts are all over. But I want to thank you for being open and honest. I think this is the first step to change.

Hello Steph,

Thanks for this lovely message. Have you got Kate’s book? If not I really recommend it. It helps to get to the bottom of the psychological stuff that’s going on and is having a much bigger effect than we realise. The question about your first money memory and how it connects to now might be a good one to start with. Also, are you charging enough for your work, do you think? Do you believe that you don’t really deserve success/money/happiness? There’s a lot of food for thought in the book.

Thanks so much for reading and sharing your thoughts. It’s so great to hear that I’m not the only one. xx

Marianne! I keep missing the email alerts and then binging on your brilliant, honest, funny musings (dangerously close to deadlines). So inspiring and such marvelous fun to read. Truly brave entry this one, and the chaos definitely struck a chord with me. (will, em, sort this weekend;) Mostly though, it brought to mind those days on the features desk, and all those gorgeous pressies you plonked in front of us gals, for absolutely no reason other than, just, well, cause; funky tea mugs, armfuls of Roly’s cappuccinos, and pints of Jo Malone perfume. And that’s not to mention the blowout birthdays! If only every boss was like you:) I sense more than a smattering of karma in your brave new world:) Love mxxx

Michelle, you are the sweetest! I may be a financial disaster but at least I shared the love along the way! Thank you for remembering and for reading… how are you? Are you well? Still writing like a dream? I always remember that first feature you wrote about wing walking and a line in it about you and a friend doing a dance routine in silver costumes, like bendy kit kats. Am I making that up? I remember laughing at loud with the image. You really really have made my day, thanks. xx

Hi Marianne

Please keep up your good work. I am also a forty something professional who earned TONS of money for a decade and nothing to show for it at this present day. I remember Careys words in STC: “where did my money go? I knew I made some!” Anyhow about two years ago I decided to turn the steering wheel around and low and behold…it works! You cant expect big miracles but if you keep at it you build up momentum and it is soooo rewarding…for some wierd reason life has started to be more fun spending less (go fgure) and on somedays I feel like I used to be as I was a twenty something year old!How wierd is that?

Long story short…..Keep going there is definitely light at the end of the tunnel!

Thank you! I remember that line in SATC as well as the one where she tots up how much she’s spent on shoes. I don’t’ even have shoes to shot for it. Thank you very much or reading and taking the time to write. I needed much more than a month on the money stuff, it will be ongoing…

Neens, thank you! x